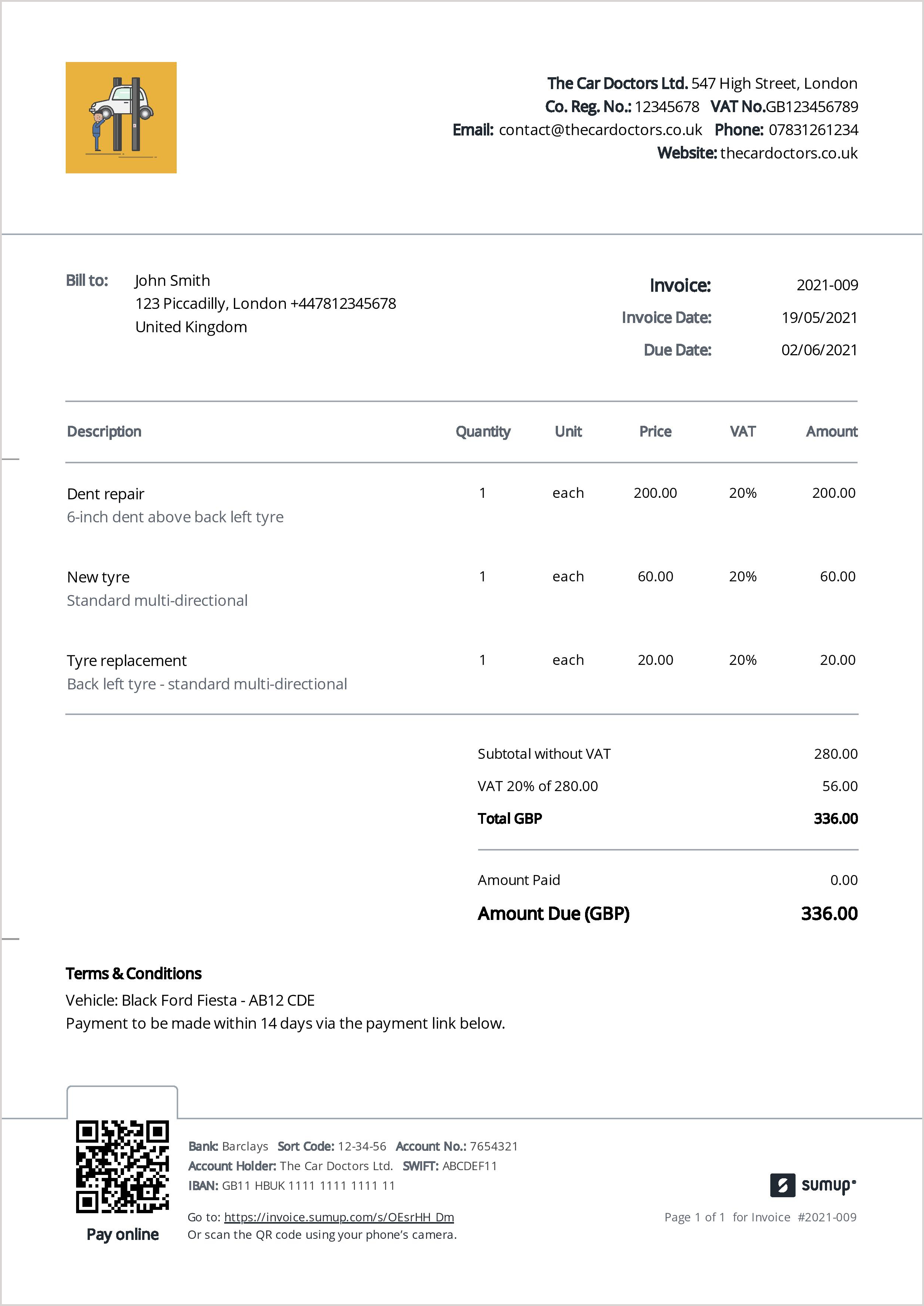

Our software allows you to create and send digital invoices and receipts with minimal human intervention. Volopay offers business-wide solutions to all your accounting and financial needs. Perform all your accounting tasks in one place while saving time and money.

#Invoice vs receipt manual#

The manual method leads to a huge waste of time writing the invoice and receipt details in various books.īusinesses can escape this cobweb of manual entry systems with Volopay and ditch the traditional way of filing and bookkeeping. With the automation software, creating and storing all accounting records is as easy as ever.Įmployees need not wander and juggle between a huge stack of paper invoices.

Not only does this make companies lose their financial records, but it also hampers financial reporting while filling for tax purposes. A statement ticks off those invoices that have been paid and confirms the amount still owed.

If you are a restaurant business, the receipt you are issuing is considered an Official Receipt. However, restaurants also have service charge and offer the full experience, not just the food. Account statements are helpful if you send multiple invoices to the same customer. When you dine at a restaurant, the receipt issued may appear to be a sales invoice as it displays products and goods sold.

For example, the invoice may require the buyer to make a payment within 30 days of receipt, and it may specify a late fee. Receipts confirm that a payment has been safely received and can be sent out as verification that an invoice balance has been settled. In addition, invoices include contact information and payment terms. It involves printing and storing these records while exposing them to the risk of being misplaced or stolen.

0 kommentar(er)

0 kommentar(er)